Technology has opened up amazing possibilities for staying connected and independent after 50—but it also brings new risks. From phishing emails to AI-generated scam calls, tech scams targeting seniors are getting smarter, sneakier, and more sophisticated.

If you’re over 50 and spend time online, it’s essential to know how to spot a scam before it happens, protect your information, and feel confident using technology safely.

This 2025 guide breaks down the most common tech scams targeting seniors, how they work, and—most importantly—how to avoid becoming a victim.

Why Seniors Are Often Targeted

Scammers often target adults over 50 because they believe:

- You may be less familiar with new tech

- You’re more likely to answer unknown calls or emails

- You may have accumulated savings or home equity

- You tend to be polite and trusting—traits scammers exploit

But with a little knowledge and vigilance, you can stay one step ahead of the fraudsters.

Top Tech Scams Targeting Seniors in 2025

1. AI Voice Cloning Scams (“Grandparent Scams 2.0”)

How it works:

Scammers use AI to clone a loved one’s voice—then call pretending to be that person in an emergency.

What to look for:

- A frantic call asking for money

- Being told “don’t call mom/dad, I’m in trouble”

- A voice that sounds just like your grandchild

How to avoid it:

- Hang up and call the real person directly

- Use a family “safe word” that only you know

- Never wire money or give gift card numbers based on a phone call

2. Phishing Emails and Texts (Smishing)

How it works:

You receive a message claiming to be from your bank, Amazon, Medicare, or another trusted source, asking you to “verify” something or click a link.

What to look for:

- Urgent language like “Your account has been locked”

- Typos or slightly off email addresses

- Requests to click links or download files

How to avoid it:

- Never click suspicious links—go directly to the company’s website

- Use two-factor authentication when possible

- Call the company using a known number, not one in the message

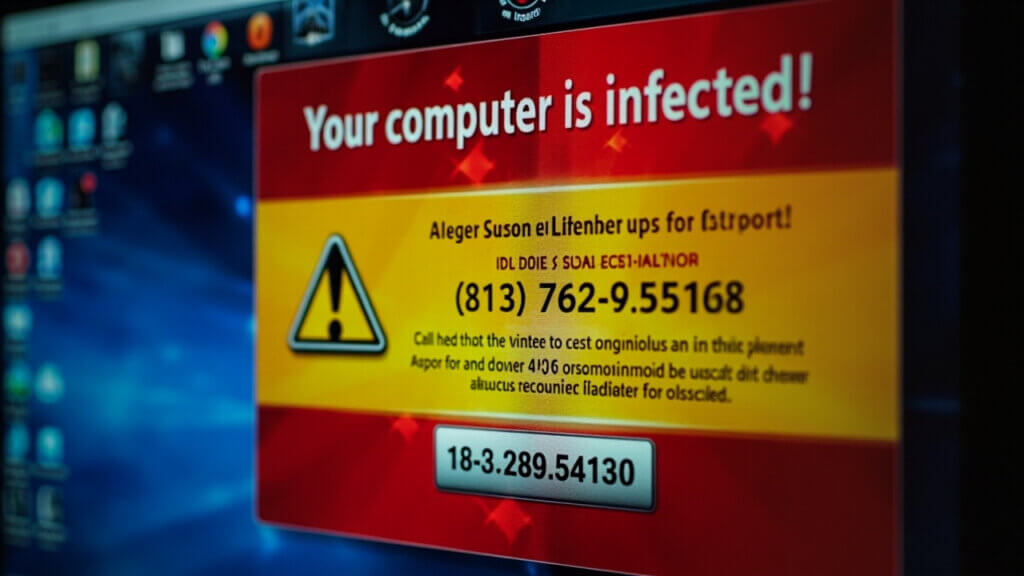

3. Fake Tech Support Pop-Ups

How it works:

While browsing, a scary pop-up appears: “Your computer is infected! Call this number now!”

What to look for:

- Unsolicited pop-up warnings about viruses

- Requests to give remote access to your computer

- Demands for payment to “fix” a problem

How to avoid it:

- Close your browser immediately

- Never call a phone number from a pop-up

- Use antivirus software from trusted providers (e.g., Norton, Malwarebytes)

4. Romance or Relationship Scams

How it works:

Someone meets you on Facebook or a dating site. They build trust, then ask for money or gift cards due to a “crisis.”

What to look for:

- They avoid video chats

- Their story involves military service, overseas work, or sudden emergencies

- They ask for financial help

How to avoid it:

- Never send money to someone you haven’t met in person

- Be wary of fast-moving relationships online

- Talk to a friend or family member if you’re unsure

5. Fake Shopping or Prize Scams

How it works:

You’re told you won a prize, or you’re offered a “too good to be true” deal on a website that looks legit.

What to look for:

- You have to pay a fee to claim a prize

- Prices are far below retail value

- The website has no reviews or return policy

How to avoid it:

- Stick to reputable retailers

- Use credit cards (not debit or wire transfers) for added protection

- Look for “https” in website addresses

Easy Ways to Stay Safer Online

1. Use Strong Passwords

Avoid birthdays, names, or “1234.” Use a password manager like LastPass or Bitwarden to keep track safely.

2. Update Your Devices Regularly

Updates often contain security patches—don’t ignore them.

3. Install Antivirus Software

Reliable protection can stop many threats before they reach you.

4. Be Skeptical of Urgency

Scammers often try to rush you. If a message says “act now!”—pause and think.

FAQs

What if I’ve already given out my info?

Contact your bank or credit card company immediately. Report scams to the FTC at reportfraud.ftc.gov.

Should I answer calls from unknown numbers?

No. Let them go to voicemail. If it’s important, they’ll leave a message.

How can I help my aging parents or friends avoid scams?

Talk openly. Share this article. Set up trusted contacts in their phone. Teach them to pause before acting.

Final Thought: Trust Yourself—And Take a Second Look

Scammers rely on fear, speed, and confusion. The best defense is staying informed, slowing down, and listening to your gut. If something feels off—it probably is.

You don’t need to avoid technology to be safe. You just need to use it wisely—and never be afraid to ask questions.

You’ve got this. Stay alert. Stay connected. Stay safe.